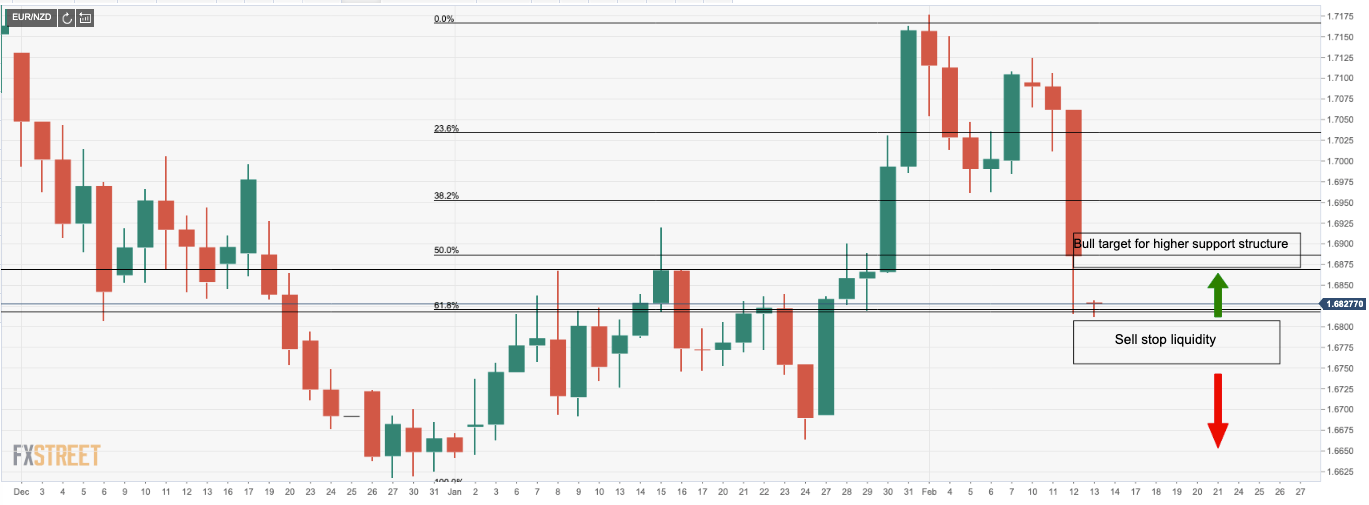

EUR/NZD huge bearish daily candlestick to critical support structure, 61.8% Fibo, eyes on Coronavirus bearish updates

- EUR/NZD drops over 1.4% following weak eurozone data and hawkish RBNZ.

- EUR/NZD bears dancing in a technically bullish commodity-complex environment.

- EUR/NZD finding support on 61.8% Fibo and critical support structure, bullish correction expected.

- However, Coronavirus new updates are now weighing on commodity currencies again.

A EUR/NZD bomb went off on committed bull's heads due to a combination of a steadfast Reserve Bank of New Zealand and following weakness in the euro as the 1.09 ground finally gave up the ghost in EUR/USD.

At the time of writing, EUR/USD is sitting in the 1.0870s, off the overnight lows of 1.0865 (the lowest since 2017) and EUR/NZD is based just above its lows after falling a hefty 1.48% since the RBNZ meeting.

Coronavirus update

The authorities in Hubei have revised their diagnostic standard for coronavirus cases.

242 deaths on Feb 12 with the death toll in the province now totals 1,310.

However, the coronavirus is hitting the wires and the numbers are not looking pretty which are weighing on risk sentiment and the commodity complex:

- CNH down.

- Copper takes a wallop falling 0.87% on the news.

- the S&P 500 futures on Globex are down.

- AUD/JPY -0.66%.

Hawkish RBNZ

Meanwhile, while the RBNZ aired caution around the coronavirus and threats to the domestic economy, which the central banks says is already impacting negatively, optimism shined through the cracks and portrayed a hawkish spin on the event.

The RBNZ said that there is no chance of a rate cut in 2020 and gave the following hawkish projecions:

- RBNZ sees TWI NZD at around 72.2% in March 2021 (pvs 71.5%).

- RBNZ sees the official cash rate at 1.03% in March 2021 (pvs 0.9%).

- RBNZ sees the official cash rate at 1.01% in June 2020 (pvs 0.9%).

- RBNZ sees official cash rate at 1.1% in June 2021 (pvs 0.94%).

The RBNZ also said the overall impact of coronavirus on New Zealand will be of short duration.

Meanwhile, the risk-on sentiment was boosting the commodity complex overnight. The CRB index shot higher and copper was also on the move, with both of these economic growth barometers now basing from a higher low on their daily charts – a more positive environment for the antipodeans all in all. However, the coronavirus headlines will keep the complex on a knife-edge and it will not take much to shake out weak bulls.

Euro was the underperformer

Then on the euro leg, we have seen a pillar pulled from under the eurozone economy with the disappointing industrial production data. The Eurozone January industrial production reflected the weakness in national releases, contracting -2.1% MoM (est. -2.0%), with the annual rate well below expectations at -4.1%YoY (est. -2.5%). This is a major blow to a sector that was thought to be bottoming. Consequently, this may have been the straw that broke the camels back. While a correction above 1.0925 could be in order, the data and subsequent reaction in the market is significantly bearish for the eurozone's and the single currency's outlook this year.

EUR/NZD daily chart and levels

Price is holding here and sell stops will be placed in usual territory below the support structure. Should these be triggered and risk-on sentiment continues with further supply in the euro, the upside corrective trade outlook will be diminished. However, a correction that holds above 1.6870 could lave the bulls on a solid foundation prior to the next major impulse to the downside.